single life annuity table

Citation needed These rates are in turn largely dependent on long-term gilt yields and mortality data. Unsecured or alternatively secured.

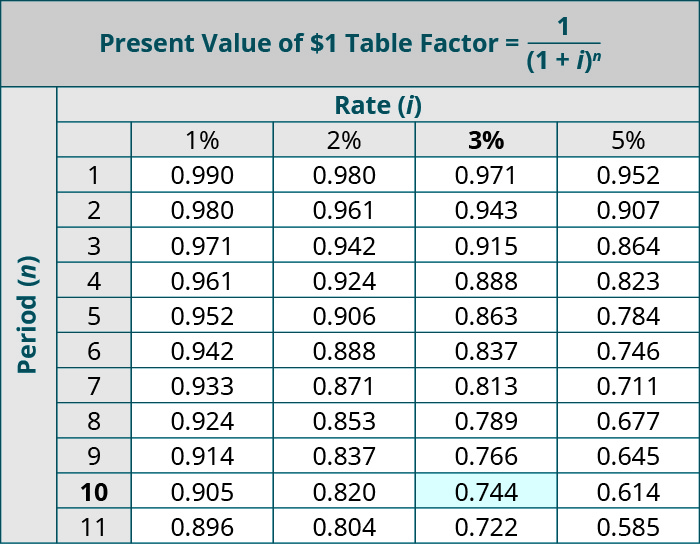

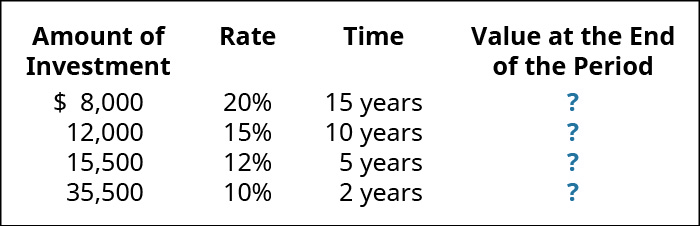

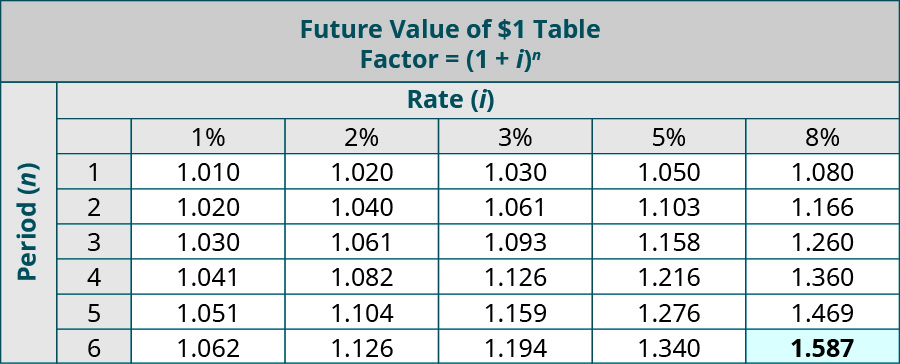

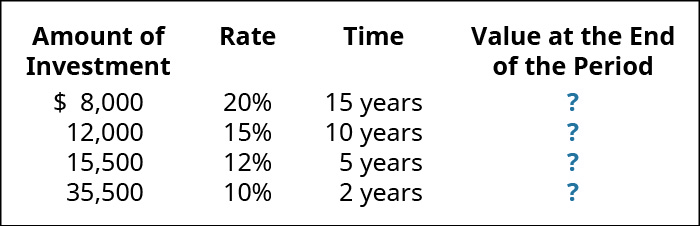

Explain The Time Value Of Money And Calculate Present And Future Values Of Lump Sums And Annuities Principles Of Accounting Volume 2 Managerial Accounting

The table below summarizes the life annuity options and features.

. Choosing Among the Annuity Options The value of the total expected payments under all of the annuity options is comparable but the amounts of each monthly payment that you receiveand the provision for continuing payments to a survivor or beneficiaryare different. Upon payment of the death benefit the policy shall terminate and all other benefits shall cease. ASingle Life The annuity will be payable in arrears post deferment period as per payment frequency chosen by you for as long as the annuitant is alive.

However BERS assist members in. A uniform distribution table is generally used to determine the factor to apply to your account balance. Based on an interest rate of 42 percent the present worth of an annuity of 100 per annum payable annually at for such time as a person aged 65 survives a person aged 60 is 17760 determined as follows.

For example a monthly annuity payment. Single Life Income Factor from Table S42 age 60 055232 Required Income Factor 062691 055232 007459. If you are a member whose spouse is more than 10 years younger and your spouse is the sole beneficiary of your TDA account you can use a factor from the IRS joint life expectancy table as an alternative to calculate your annual RMD amount.

Single life annuity paid monthly in arrears without any guarantee or value protection for an individual in good health. Joint and Survivor Annuity Factor from. An annuity depending on the continuance of an assigned life or lives would commonly be called a life annuity.

On death of the annuitant death benefit is payable as lumpsum to the nominee and no further amount will be payable.

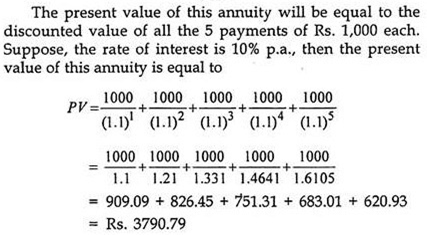

Explain The Time Value Of Money And Calculate Present And Future Values Of Lump Sums And Annuities Principles Of Accounting Volume 2 Managerial Accounting

Explain The Time Value Of Money And Calculate Present And Future Values Of Lump Sums And Annuities Principles Of Accounting Volume 2 Managerial Accounting

Time Value Of Money Meaning Importance Techniques Formula And Examples

Best Fixed Annuity Rates March 7 2022 Up To 3 25

Present Value Of Ordinary Annuity Table Hadiah Buatan Tangan